The Story Of Tetsuro Hara Whiskey And The Chaotic Lead Journeys

Film Director Panos Cosmatos tells a fascinating story in his work “The Viewing” about a particular whiskey called Tetsuro Hara, a 50-year-old single-malt whiskey produced in a distillery that opened in 1921 in a small suburb of Kyoto, where the water was so revered that legendary tea masters had been coming there for centuries to perfect their brews.

This particular bottle survived the aerial bombing in World War II that damaged that distillery. The bottle then fell to the ground during the Nankaido earthquake of 1946 and still survived.

The protagonist goes on to say how the whiskey survived through all that chaos leading to that specific night for them to enjoy it.

It’s true what they say: work too long on something - you start seeing it every day. The first time I heard this story, my instant association was with the lead journey, and for a good reason.

Various studies have shown that it takes about 8-12 touchpoints before you can close a deal. During this time, a lead has been through many hoops - a form fill, a webinar attendance, half a dozen emails and calls, POCs, demos and negotiations, and finally, hopefully, a win.

While in our previous blogs, we covered how the Top of the funnel has become more critical than ever (here and here) and how boards are becoming analytical about funnel metrics (link to blog), in this one, I wanted to lay emphasis on the demo to closure conversion.

The Demo To Closure Journey

When a lead has gone from Marketing Qualified Lead(MQL) to Sales Qualified Lead(SQL) and landed in sales territory for a demo, it is like the Tetsuro Hara whiskey bottle that has been through half its chaotic journey and moving ahead. At the demo stage, the curtain over the lead actually being the right Ideal Customer Profile(ICP) is figured one last time.

If most of your demos qualify down the funnel, you are good. But what if it doesn’t? What does it tell you that many of your demos are dropped?

For every organization I have worked with, one of the first things I analyze is “deal spread” - to get a sense of where the opportunities and leads spend most of their time. It gives a sense of whether the customer journey has been mapped correctly.

One of the things I have consistently seen happen is a bulked-up first stage. Meaning there are far too many opportunities sitting in the first stage of the funnel than any or getting dropped from the first stage to lost.

And dissecting this, I have discovered two things cause this:

- Poor qualification at the lead level (Top of the Funnel)

- Poor structuring of CRM

For the sake of this blog, I will expand on the first point. When an opportunity is passed to sales, the understanding is that it was qualified for BANT (Budget, Authority, Need, and Timing).

In short, it was checked for ICP fit.

But when sales discover that an opportunity does not meet the ICP, they either mark it dropped or leave it, mainly if your CRM was not structured well enough to ensure the rep’s win rate is not affected by a bad deal being marked lost.

Brick And Brick Together A Pyramid: Understanding The Scale

To appreciate the scale of the problem, imagine there are 500 leads marked MQL for the Qtr. Say 300 make it to Opportunity level. That’s a 60% conversion rate. Say it takes you an average of 3 days to convert the lead into an opportunity.

Say of 300 of these opportunities, 80 get dropped by sales to reasons like “no budget,” “misunderstood our offering,” etc. That’s ~27% of all opportunities being dropped.

At this point, here’s all that’s happened:

- 60% of MQLs were converted into Opps

- 27% of those Opps were dropped for being poor ICP fit

You have lost hundreds of hours of company time pursuing the wrong leads. This not accounting the opportunity cost of using that time to follow with the right ones.

What does this tell you? That the SDRs do a poor job of qualifying? Sure, to some degree, if you did not train them well. However, if you play in a high lead volume game, your SDR teams will always need help to go after the right leads. How do you fix this problem?

Well, we wrote in detail about it here.

The reps know the deal. They do not know the historical trends.

Returning to our example, notice that 73% of all opportunities make it to the next stage. However, quite a few deals will drop at subsequent stages and end the funnel with a few wins. So how do you ensure your reps are going after the right deals once the pipeline is logged?

- Converting leads that meet your ICP to opportunities

- Knowing what industries have historically worked for you

- What titles, regions, and campaigns have worked in the past

If you could dissect your opps down to every stage-level conversion, you have hit the goalpost. Example: 33% of all opportunities from the Pharma industry converted from Demo to Proof of Concept(POC). 21% of opportunities from POC moved to Negotiation from APAC.

If you know that level of detail, knowing exactly what opportunities to go after at what stage, you naturally start seeing your velocity to close getting a lot more efficient, your win rates improving, and most of all, your revenue jumping.

When the pandemic kicked in, sales reps did something they presumed was the right thing to do. HubSpot data found that sales teams boosted their emails to prospects by 50%. Coz the events were canceled, in-person meetings got canceled (two crucial touchpoints for conversion), and the sales reps doubled down on touch points at their disposal. That, however, was unscientific.

Hubspot data found that the response rates from buyers dropped to an all-time low. This study was learning post-fact - after months and a year into the pandemic. If an app could track what works for you right when you do it and build trends to go after the exact deals, you would have hit the jackpot!

However, we have yet to address a mighty beast in the pipeline. And naturally so coz it is the nature of the beast to lurk in the darkness and be invisible while doing all the harm it can.

We Act On What We Know. What We Do Not See, We Do Not Acknowledge

Notice we are doubling down on what is working out. What about cutting down on what is not working out?

Let's say the analysis tells you that historically only 3% of opportunities from the Entertainment industry converted from Demo to POC. And you have 12 such opportunities in your pipeline - adding a total of $500K to your logged pipe.

Would you act on these opportunities with the same rigor as the pharma opps, which have historically converted 33%?

You would shift your focus from what is not working to what is working. What does it tell you that you have 12 such opportunities from Entertainment in your pipeline in the first place? Poor Top of the Funnel(ToFU) demand gen campaigns.

The ultimate goal of any funnel analytics team is to tie it all together, to tell one beautiful story of what is working at every stage of the funnel: which rep is working well, what campaigns to double down on and which outreach programs to cut down.

Thankfully this does not have to be a dozen spreadsheets for you.

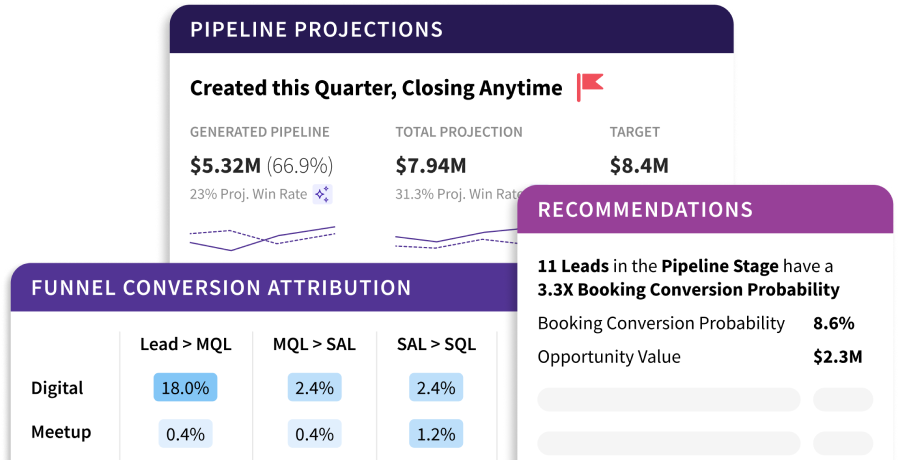

We spent enough time with experts like yourself to automate it all: a full-funnel view and a predictive analytics platform that identifies “pipeline that you have not even logged,” conversions across every part of the GTM funnel, and insights that you never had (except unless you have a 6-member data science team whose only KPI is to dish out insights from dozens of google sheets).